Market Report: Economic Growth & GDP Returns

Market Report: Economic Growth & GDP Returns

To our clients,

I wanted to summarize the past few months by thanking our staff for the tremendous efforts that went into launching the new platform that helps us do a better job of servicing your accounts! The good news for us is that the whole operation was a big success, and we are now in a better position to optimize our retirement planning, investment management, and tax optimization recommendations.

That being said - it also led to a delay in the first set of quarterly reports that are available to us. Reconnecting the databases took a little time. Reports will typically be made available by the 15th of the month following a quarter end. (For clients where we are reporting on accounts held away, this timeline will be a little longer.)

For your information - there are other reports available including monthly snap shots, different “recent periods”, comparison to benchmarks, and reports that show returns for each account and period. In upcoming meetings, we will discuss other documents that are available based on the level of planning that we are doing for your household.

Economic Overview

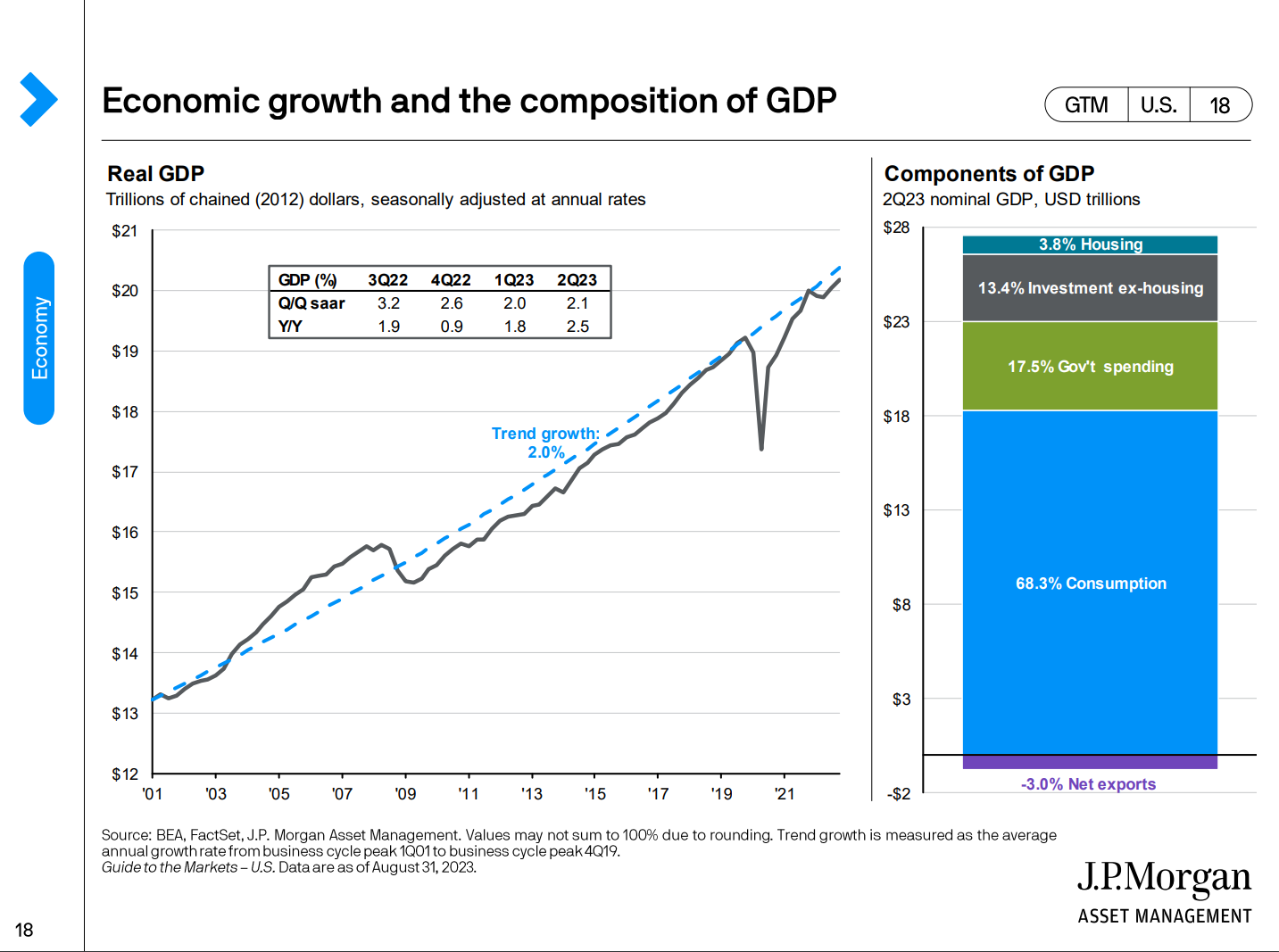

It is an interesting observation that the general sentiment about the economy is more negative than positive. The actual market and economic data tells a very different story. Year to date (Sept 15, 2023) the market has done an impressive job of rebounding, shrugging off the small interest rate hikes and powering past the naysayers who are still predicting an imminent recession. The actual numbers are terrific the S&P is up 16.4% year to date the Dow Jones is up 5.3%, the unemployment number is the lowest it's been in years, and most surprisingly the economic growth numbers are at 2.1% meeting the average growth rate of the past 10 years. There are always sectors that are doing better than others – for example, Apple is up 41% YTD, and the chip producers are all up with the video card firm Nvidia leading the way and up more than 210%.

So why the doom and gloom? Well one of the issues is that while most of the tech economy has taken off again, the dividend equities and bond portfolios have done poorly, so defensive investing has not produced results and is still well behind. Another reason is the ongoing concern about inflation.

Inflation is not a sign of a weak economy, rather a sign of an overheated economy where consumers have more money than they need and supplies are hard to get - so much so that they can change the prices. What the Fed did during 2022 was attempt to slow the economy down - to dampen consumer enthusiasm and increase interest rates to make it harder to buy houses, cars, expand businesses, et cetera. It worked!

Now, everyone feels bad and the economy has been brought well down since January 2022, but most of that was last year. This year has actually done quite well in spite of all of that. The last observation is that despite the huge market increases this year, most investors are still down from the high market point of January 2022. Reminder – the market went up 28% in 2021! Perhaps a better way to look at investment performance is over the past three years. The S&P has gone up and down and back up since then - it is now at an average return of over 8% for the three-year returns not bad. (DJIA - trailing 3 year returns as of Sept 15, 2023)

Overall, I feel confident that the reports that are released from multiple financial authorities means that we're doing just fine. Of course, I understand that if you have further concerns from what you hear on the news- but these numbers are the solid foundation that I like to base my advice on.

**Year to date market data taken from Yahoo Finance. GDP data provided by JP Morgan Guide to the Markets.